|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

auto repair coverage insurance that keeps performance front and centerYou're weighing protection that won't slow your car - or your life. With the right plan, you keep momentum: fast claims, smart parts, and coverage aligned to how you drive. You want fewer surprises, more confidence. Still, the fine print can blur, and what sounds simple on a quote screen can shift. What it can coverExpect options for powertrain, electronics, air conditioning, steering, and even sensors that affect drivability. Better plans include diagnostics and ADAS recalibration, since performance is more than parts. Exclusions exist; modified components and wear items can be tricky. Your priority checklist

A real-world momentFriday commute, a coil pack fails; you tap the app, the tow arrives, and the adjuster approves OEM coils and labor the same afternoon. You're back by Sunday. Another week, a minor oil leak needs dye testing - approved, but the gasket isn't - so maybe it's not that simple. Offers to weigh

If an offer boosts drivability and uptime - not just price - it's worth shortlisting. Skim a sample contract and the shop network before you decide. https://www.trustage.com/learn/property-insurance/mechanical-repair-coverage

Mechanical repair coverage is different than regular car insurance because it may cover repairs made by a mechanic, which could help minimize repair bills. https://www.youtube.com/watch?v=1upkQ4e7lic&pp=ygUUI2JyZWFrZG93bmNhcnNlcnZpY2U%3D

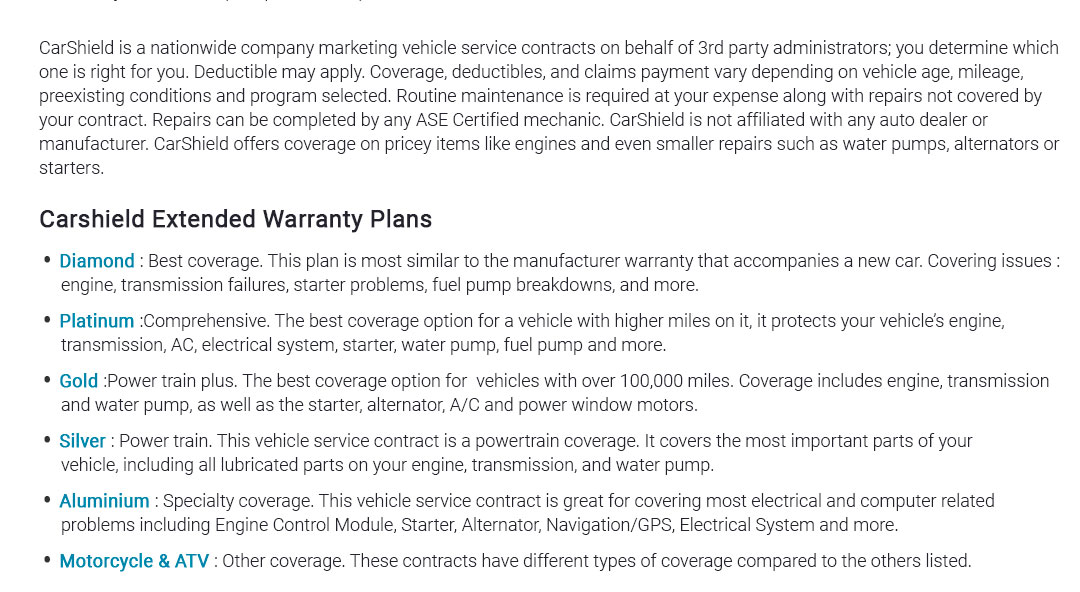

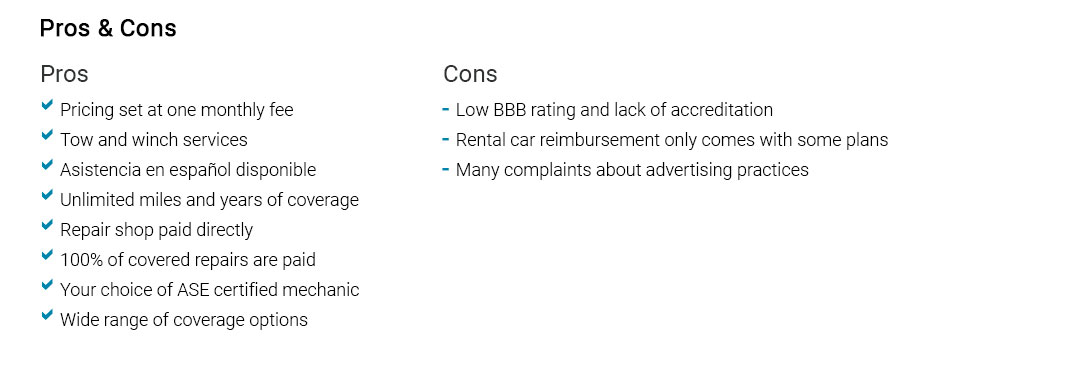

We've all seen the commercials about auto repair insurance, also known as vehicle service contracts, that are supposed to protect you when ... https://carshield.com/

A vehicle service contract through CarShield is relatively inexpensive, and includes additional services you'll need to survive a major car repair.

|